Calling All Real Estate Professionals!

What is a REALTOR-LO?

A Real Estate Mortgage Loan Officer

Exclusively for select top producing agents

Gives you the ability to offer purchase and refinance lending services to your clients in 48 STATES! Sorry Massachusetts and NY .

“White Glove” Concierge team handles the loan production process for you

Allows you to earn a commission for your buyer clients and REFI clients that you refer to us.

Allows you to earn a Revenue Share on any other Realtors you tell about the program

Want to know how much you can make as a Realtor-LO?

Who is behind the REALTOR-LO program?

Nexa's Realtor-LO program is a natural extension of a Realtors business model, which is characterized by high margins and profit-sharing. This program not only enhances the earnings potential for realtors but also aligns with Nexa's mission of providing innovative solutions and maximizing profitability for its partners. By enabling realtors to also serve as loan officers, Nexa is creating a synergistic model that benefits all stakeholders involved.

So What Exactly is a REALTOR-LO, again?

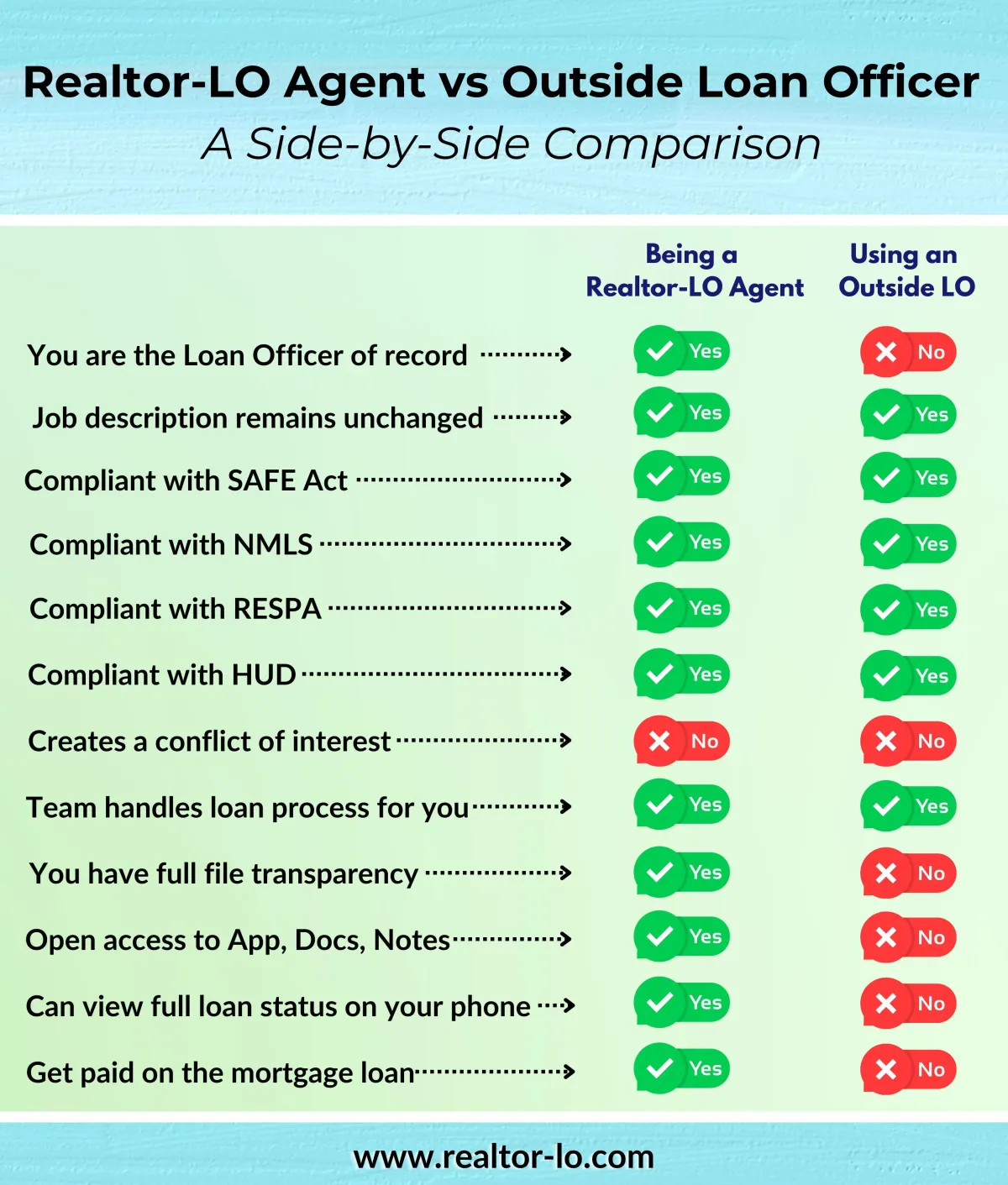

A Realtor-LO Agent is a Real Estate Professional who is also Mortgage Loan Officer. This statement normally raises a number of “yeah, but....” kind of questions. This chart is a quick guide that will help to answer some of them.

Again, the quick explanation is that in addition to earning your normal Real Estate commission, the Realtor-LO program allows you to earn a commission on the mortgages associated with your Real Estate transactions. The key things to remember:

1. You will need to get your LO license but we will assist you in that. Its just 20 hrs...

2. You don’t need to know or learn the loan production process because your “White Glove” Loan Concierge Team handles the loans for you from application to closing.

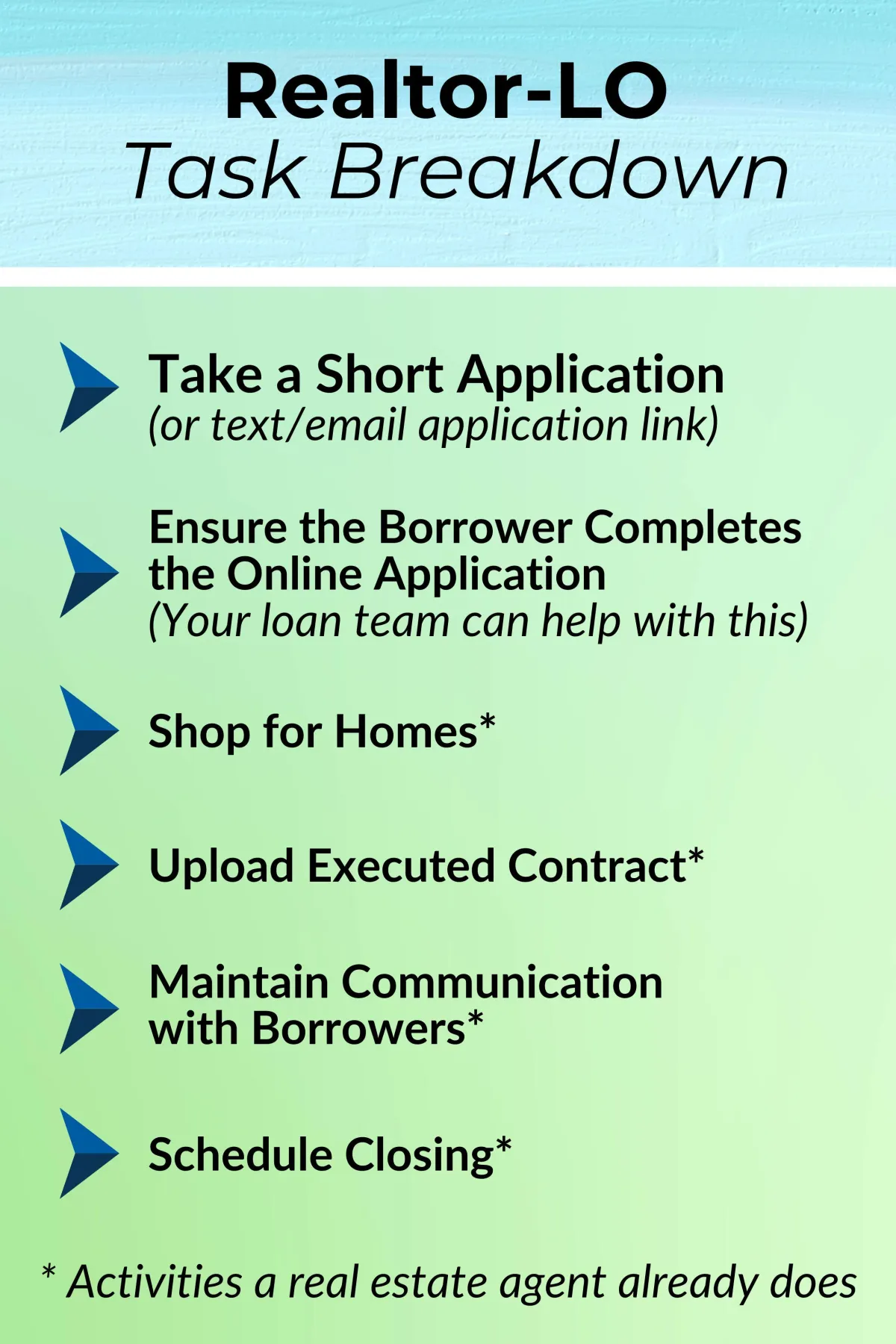

What does a REALTOR-LO Agent do?

Perhaps the better question is “What does a

Realtor-LO Agent NOT do or not HAVE TO do?

Reviewing this chart, we’ve been able to remove the onerous tasks that normally make Real Estate professionals think twice about becoming a loan officer.

On the “left” side, taking the app used to mean completing a paper 1003 at the clients' dining table, now it is simply sending your online link to them. Once that's started, our team can help from there, making sure that it is completed properly.

The other green tasks should look familiar as you are already doing everything else that you need to do be paid on a loan. Why give away your money?

FAQs

01 How does this work?

Easy. As a Real Estate professional, you become a loan officer with NEXA. Instead of referring your clients who need financing to an outside loan officer, “you” do the loan and get paid for it.

02 Are you nuts? There’s no way I’m jumping those hoops to get a license.

Its actually a lot easier than you think. And its starting to happen all over the US. This just gets you in on the front end of it. We can help guide you through it. And its only 20 hours.

03 Wait! I’d be the Agent and LO on the same transaction?? Isn’t that a conflict of interest?

Actually, it’s not. It was only ever considered a conflict by HUD and only for FHA loans. But that changed in December of 2022 when HUD updated its “conflict” definition to exclude loan officers. It’s no longer considered a conflict by any federal governing body or organization. Note: You will have to get an Affiliated business disclosure signed by the client to let them know your affiliated but that's it.

04 No thanks. I’ve already got a job! 😂

That’s the beauty of the REALTOR-LO program. With our “White Glove” loan concierge team, you don’t need to learn the loan production process. Your\our team will handle the loan from application to closing. Your job description really doesn’t change. Right now, you refer your buyer to a loan officer, and they handle the process. With REALTOR-LO, you’ll simply text or email your application link, refer them to your (inside) loan partner and your loan team will handle the process. It will work the same except with REALTOR-LO, you’ll get paid. 🎯👍 Of course, there are normal Agent tasks to complete, i.e., shopping for houses, uploading an executed contract, communicating with the client, and scheduling the closing.

05 So then...how much WILL I get paid?

On the vast majority of loans, Realtor-LO Agents receive a payout of 50 basis points at closing. For easy math, that’s $5,000 for each $1 Million in loan volume. Of course, it’s paid on whatever the actual loan amount is, so a $500,000 loan would be $2,500 and a $200,000 loan would be $1,000, etc. You can also get paid Revenue share for any other Realtors you tell about the program.

06 Would I need to move to a different RE Broker?

Absolutely not! You may be a Realtor-LO Agent with any broker you choose. Your choice of broker has no bearing on your standing as an employee with NEXA.

07 Would my loan commissions come through my RE Broker like my other commissions?

No. your commissions will come from NEXA.

08 What loan programs can I offer?

As mentioned earlier, in addition to their own programs, NEXA is the largest wholesale lender on the planet. We have more programs than any in the history of mortgage. If a program exists we likely offer it.

09 Will my rates be out of the market, or will I be competitive?

You will have broker pricing so yes, you will be extremely competitive

10 What if my client somehow wants/needs a program I don’t have?

That would be unusual but if they have found a program that we dont offer, they are always free to use that program with whomever is offering it. Remember, we can’t compel them to use us. They are free to choose whomever they would like.

11 Will my current E&O insurance cover this or will I need to get a different policy?

Neither. You will be covered by the NEXA's policy. This won’t affect your current policy and you won’t need to buy a new one.

12 What about RESPA?

What about it? 😂 The Realtor-LO program doesn’t change anything about RESPA. It will keep right on RESPA-ing. As a Realtor-LO agent, you are considered a dual-capacity employee. Section 8 of the RESPA code provides an exemption to dual-capacity employees. So even though it is still there, it has no effect on Realtor-LO.

13 Is this ONLY for mortgage loans associated with my RE transactions?

Certainly not! As a Realtor-LO Agent, you are a full-fledged mortgage loan officer empowered to write mortgage loans for any purpose and in any state. This could be for 1st mortgages, 2nd or other subordinate mortgages, HELOCs, etc. These could be for purchases, refinances (R/T or Cashout), debt consolidation...anything!

14 Would I work with the same team for all of my loans?

Yes. There is no round-robin pool of Loan Partners or Loan Officer Assistants. You will work with the same awesome team on all of your loans unless and until we all decide that some change needs to be made that will somehow improve the operation.

15 What if I get stuck with a loan partner who is a jerk?

Let us know and we’ll assign someone else to you (who is not a jerk). 🙂👍

16 How much does it cost to become a Realtor-LO agent?

We have a $80 per month fee to all NEXA employees\contractors. that's it!

17 How long does it take to get setup?

That’s largely up to you. If you “get down on it”, you CAN be set up in as little a couple of weeks.

18 How can I keep tabs on my files?

So, right now if you want an update, you have to call your LO and ask what’s up. They can give you some general info, (should be CTC on Friday, etc), but not a lot of specifics. As a Realtor-LO Agent, you are the Loan Officer of record with complete transparency to the file.

19 If I’m a Broker/Owner, will I be able to do loans for other Agents in my office and get paid on those?

Of course, you dont even have to be a broker\owner. You can do loans for other realtors in your office if you want.

20 Will I be able to do loans for other outside RE Agents’ deals and get paid on those too?

Yep. (For further clarification, please review the answer to #19. 😂)

21 If this is so great, why isn’t every Agent doing it?

We’re working on that. 😂 And with the new NAR settlement it make more sense than ever. Its happening! If you get on the front end of it not only will you make more on your files but you could build a massive profit sharing check every month for telling others about it.

22 What is the process to get started?

Easy. Just scroll up and go to one of our webinars and we will fill you in on the details.